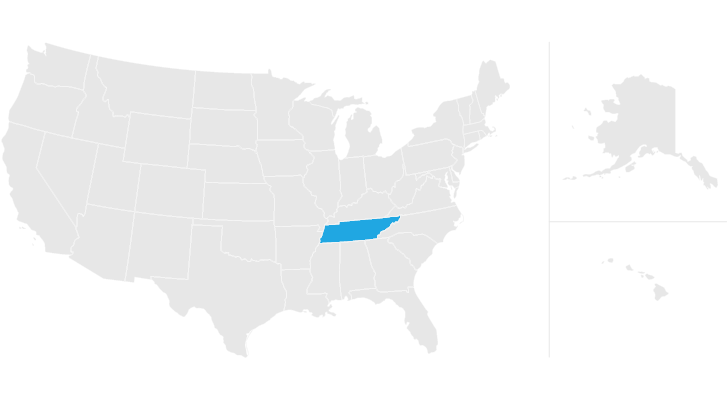

does tennessee have inheritance tax

Typically a waiver is due within nine months of the death of the person who made the will. Tennessee does not have an estate tax.

Go Titans Tennessee Titans Tennessee Titans Football Titans Football

It is one of 38 states with no estate tax.

. However it applies only to the estate physically located and transferred within the state between Tennessee residents. For example the neighboring state of Kentucky does have an inheritance tax. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax.

Tennessee does not have an inheritance tax either. Does Tennessee still impose an inheritance tax. Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015.

Tennessee does not have an inheritance tax either. Tennessee also has no gift tax. Technically Tennessee residents dont have to pay the inheritance tax.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. Final individual federal and state income tax returns.

State tax ranges from business and sales tax to inheritance and gift tax. There are NO Tennessee Inheritance Tax. Maryland is the only state to impose both.

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. The good news is that Tennessee is not one of those six states.

Tennessee is an inheritance tax and estate tax-free state. What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

Inheritance Tax in Tennessee. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. All inheritance are exempt in the State of Tennessee. The tax applies to individuals partnerships associations and trusts that are legally domiciled in Tennessee.

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Only those estates that are valued 5 million or more are subject to the Tennessee estate tax.

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. It means that even if you are a Tennessee resident but have an estate in. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Tennessee does not have an inheritance tax either. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses.

There are NO Tennessee Inheritance Tax. Tennessee Inheritance and Gift Tax. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. Twelve states and Washington DC. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

The inheritance tax applies to money and assets after distribution to a persons heirs. Each due by tax day of the year following the individuals death. Can you waive inheritance tax.

Tennessee is an inheritance tax-free state. IT-11 - Inheritance Tax Deductions. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state.

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. All inheritance are exempt in the State of Tennessee. Due by Tax Day of the year following.

A person who is legally domiciled in another state but maintains a place of residence in Tennessee for more than six months of the year is also subject to the tax however this does not apply to military personnel and full-time. Impose estate taxes and six impose inheritance taxes. If you do owe Tennessee state taxes other than income tax you can learn more about what is taxed at the TN Department of Revenue website.

According to the Tennessee Department of Revenue Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The inheritance tax is levied on an estate when a person passes away.

The inheritance tax is paid out of the estate by the executor. If the deadline passes without a. Federal estatetrust income tax return.

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. Do Tennessee residents have to worry about an inheritance tax. Inheritance taxes in Tennessee.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Those who handle your estate following your death though do have some other tax returns to take care of such as. The inheritance tax is different from the estate tax.

For the purposes of this post we are going to address the last question about Tennessees inheritance tax. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. An inheritance tax is essentially a tax on the amount of money or assets the heirs or beneficiaries of an estate receive.

There is a federal gift tax though which has an annual exemption of 15000 per year for each gift recipient. Inheritance Tax in Tennessee. To pay taxes you may do so online at httpstntaptngoveservices_.

However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

Tennessee Inheritance Laws What You Should Know Smartasset

Where S My State Refund Track Your Refund In Every State

Pin By Graceful Aging Legal Services On Estate Planning Estate Planning Attorney Legal Services Estate Planning

Rv Living How To Make It Without A House Infographic Map Real Estate Infographic Estate Tax

As Mortgage Rates Climb Affordability In The Most Expensive Markets Has Suffered Driving More People To Affordable Lo Los Angeles Job Center Mortgage Banker

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

Historical Tennessee Tax Policy Information Ballotpedia

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tennessee Inheritance Laws What You Should Know Smartasset

Tennessee Tax Free Weekend Is Coming Up What S On Your Shopping List Tax Free Weekend Weekend Is Coming Tennessee

Tennessee Retirement Tax Friendliness Smartasset

Pin By Laura Alexander On Eats Treats Grilled Cheese Food Truck Food Truck Grilled Cheeserie

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

State By State Guide To Taxes On Retirees Retirement Locations Retirement Advice Retirement

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Income Tax Return

Tennessee Retirement Tax Friendliness Smartasset